Pion HR - Best Payroll Software

Pion HR payroll software revolutionized the Indian payroll industry. We re-imagined and set a benchmark on how an enterprise payroll management system could be simplified.

Welcome to SGCMS, the name people trust for bringing the best payroll software to small businesses in Delhi and NCR regions in India. We are the leading payroll outsourcing company in the country and we are proud creators of the PION HRMS Software. Let us give your business the software it needs to make payroll management easier and more effective

At SGCMS, we deeply understand what processing payroll is all about. We make it easy for small businesses to process payroll for employees, know exactly how much an employee is making every month, and even find out what their TDS is so that it can be paid conveniently. Filing income tax returns is easy with our payroll software in India. Overall, we are the complete payroll solution you were looking for.

Get 24/7 remote access to your payroll information

Bringing you peace of mind about Frequently changing regulations

Assistance from experienced SGCMS professionals for all payroll system queries

A system of record for your employees which streamlines processes

Did you know that payroll management is one of the most critical tasks that a business does? When your business depends on the work your employees do, make sure they get paid on time and their TDS gets calculated on time for easy filing of tax returns.

That is why you will be doing the right thing by outsourcing your payroll management to SGCMS. With our 45 years of experience behind us, we can say for sure that we have what it takes to help with your business. Ensure that payroll management gets done the correct way with help from us. We are well qualified to make it happen.

At SGCMS, we understand how important it is to have happy and satisfied employees. We play a small part in making that happen for your business. Make sure your employees get what they need on time: accurately calculated salaries and leaves. This is made possible with payroll service software from us. Outsource the whole task of payroll management to our company and see the difference it makes. It will certainly lead to happy employees who will go a long way in giving your business the boost it needs.

Welcome to PionHR, where we revolutionize the way businesses manage their payroll in India. With our comprehensive payroll software, we ensure a seamless and satisfying employee journey from onboarding to retirement. From the very moment an employee joins your organization, PionHR takes charge of the entire payroll process, leaving you with more time to focus on what truly matters - your people and your business

Embrace the future of payroll management with PionHR's advanced cloud-based solution. Say goodbye to traditional, cumbersome payroll systems and welcome a new era of efficiency, security, and accessibility. Our cloud-based platform empowers you to access payroll data anytime, anywhere, with just a few clicks. Rest assured that your sensitive payroll information is safeguarded by state-of-the-art security measures, allowing you to focus on running your business confidently.

At PionHR, we understand the importance of empowering your employees. Our intuitive self-service portal puts the power of payroll in their hands, allowing them to access their payslips, tax information, and more with ease. No longer will your HR team be bogged down with routine queries, as employees can conveniently update their personal details and manage their payroll preferences directly through the portal. This streamlines processes, boosts employee satisfaction, and enhances overall productivity.

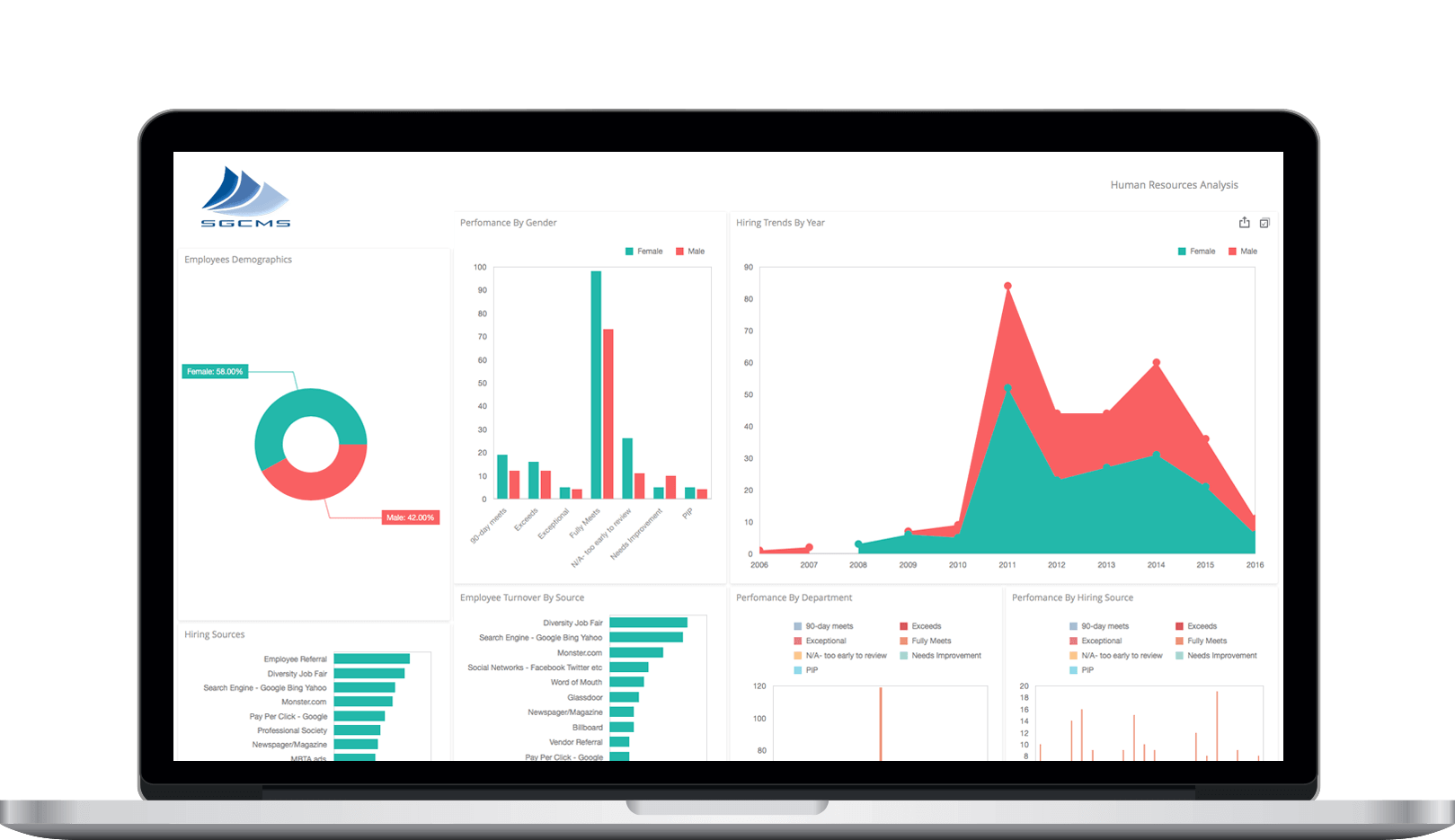

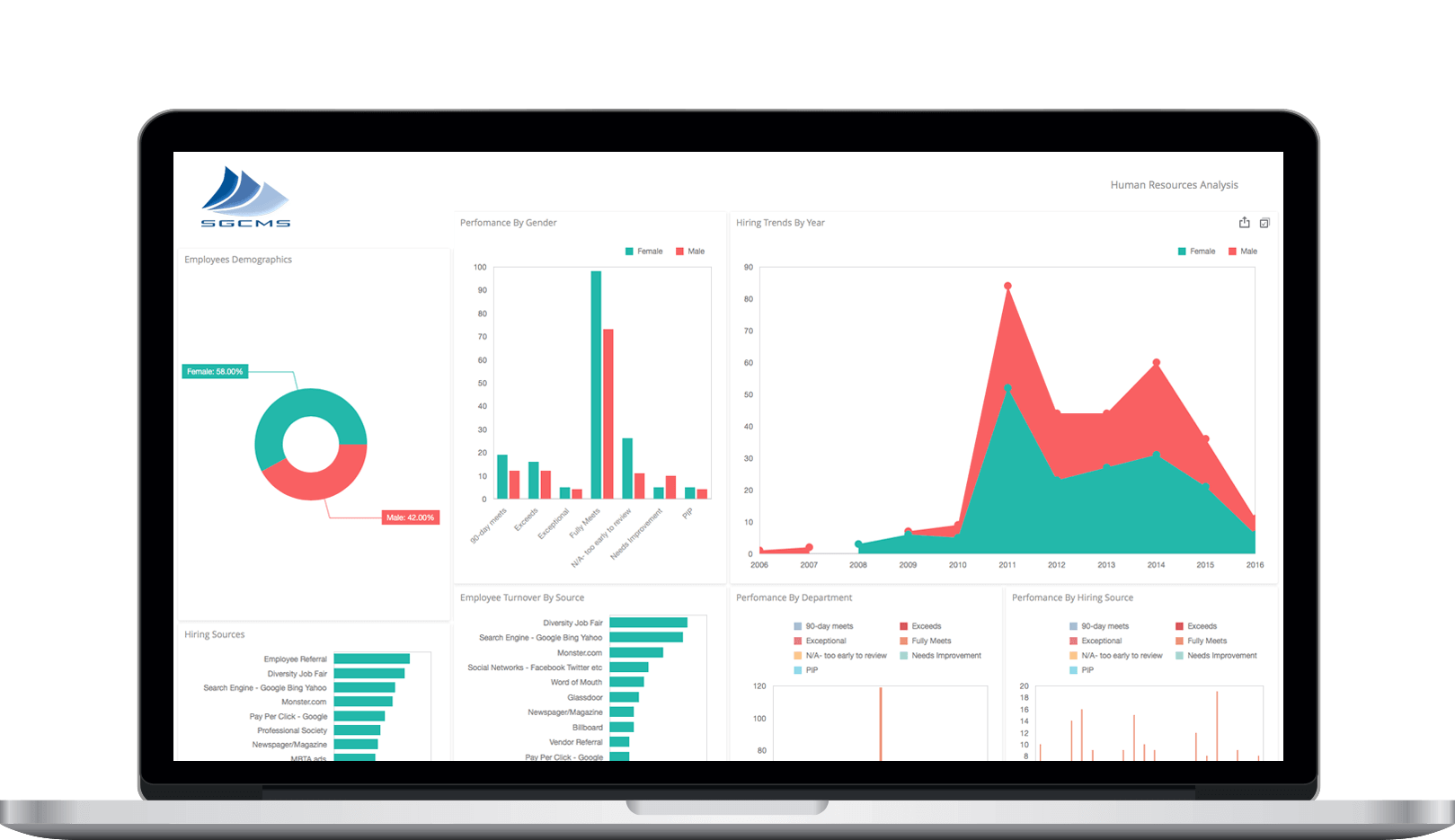

Gain valuable insights into your organization's financial health and workforce dynamics with PionHR's comprehensive reports and analytics. Our software provides you with a treasure trove of data-driven intelligence that empowers you to make informed decisions. From payroll summaries to attendance patterns and more, we help you unravel critical trends and discover opportunities for growth and improvement. Welcome to a world of data-driven decision-making - a key to unlock your organization's full potential.

Expert Customer Support from Seasoned Payroll Advisers

Seamless Application Updates, Including Statutory Requirements

Efficient Compliance Monitoring Services for Peace of Mind

Unwavering Commitment to Quality Production Control

Payroll Software Related FAQs

Yes, absolutely! PionHR is designed to cater to the needs of businesses of all sizes. Whether you run a small startup, a medium-sized enterprise, or a large corporation, our payroll software is scalable and adaptable to fit your unique requirements. You can trust PionHR to handle your payroll efficiently, regardless of your organization's size or complexity.

Absolutely! At PionHR, data security is our top priority. We utilize industry-leading encryption and security protocols to safeguard your sensitive payroll information. Our cloud-based payroll system is hosted on secure servers, regularly monitored, and protected against unauthorized access. Rest assured, your data is in safe hands with PionHR.

Yes, with PionHR's efficient employee self-service portal, employees can access their payroll information conveniently. From viewing their payslips to checking tax details and updating personal information, the self-service portal empowers employees to manage their payroll-related tasks autonomously. This reduces HR's workload and enhances employee satisfaction.

PionHR prides itself on its user-friendly interface. Our software is designed with simplicity and intuitiveness in mind. You don't need to be a payroll expert to navigate and use PionHR effectively. With easy-to-understand features and clear navigation, you and your team will quickly adapt to the system, saving valuable time and resources.

Yes, absolutely! PionHR provides a robust reporting and analytics module that allows you to generate custom reports based on your specific needs. Whether you require payroll summaries, attendance trends, or tax-related insights, our software empowers you to access and analyze the data you need for informed decision-making. The customizability of our reports sets you on the path to world-class insights.