Rectification of erroneous EPF contributions

December 30, 2025

901

Errors in Employees’ Pension Scheme (EPS) contributions are increasingly coming under scrutiny during EPF inspections and wage revision exercises. Such mistakes can expose employers to financial liability, legal non-compliance, and employee disputes if not rectified in time. This blog explains how erroneous EPS contributions arise and outlines a structured approach for their rectification.

How EPS Contribution Errors Commonly Arise

EPS-related discrepancies typically emerge when there is a mismatch between statutory provisions and the way establishments configure their payroll. In many cases, both employer and employee continue contributing to EPS on wages beyond the statutory ceiling or after the statutory conditions are no longer fulfilled.

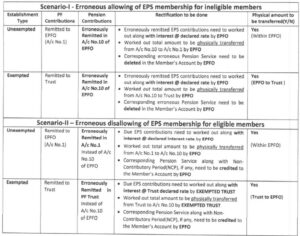

Please find the different scenarios below:

Please find attached the official notification below: